Come Clean

ERShares Private-Public Crossover ETF (XOVR) wants a redo. It doesn't deserve one.

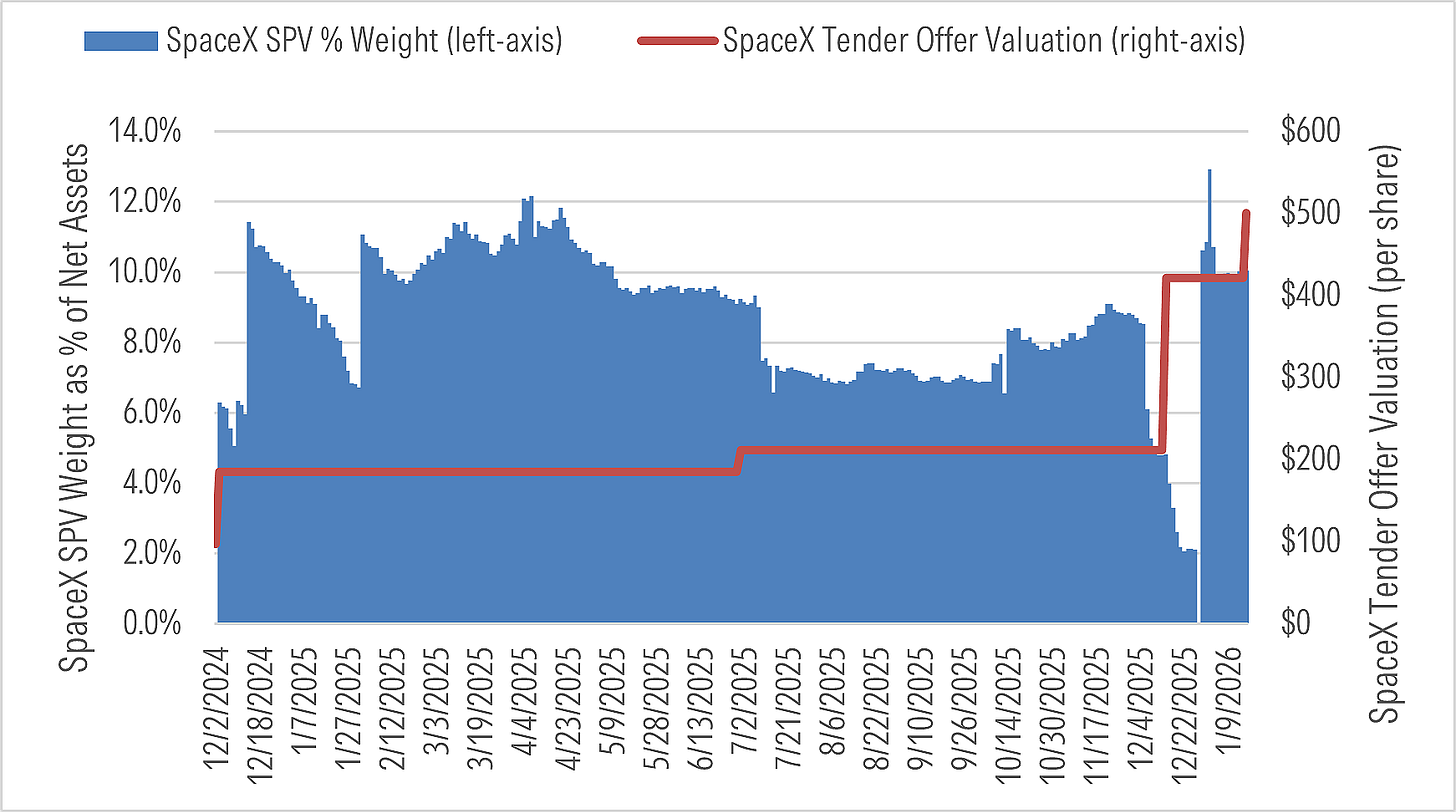

This is kind of a long post so here’s a summary: ERShares Private-Public Crossover ETF (XOVR) put out a very odd press release. In it, they said, among other things, that they were valuing SpaceX at $526 per share as part of a “transparency reset.” Until quite recently, XOVR was carrying SpaceX at a $185 per share value. Yet, despite that near-tripling of the position’s value, it’s not evident XOVR’s investors have seen any benefit. The question is why and it’s taken on greater urgency in recent days amid a spate of outflows from XOVR, swelling the SpaceX stake to more than 18% of net assets.

Yeah, this ETF again.

I last wrote about ERShares Private-Public Crossover ETF (XOVR) a few weeks ago. At the time, I observed it wasn’t tracking its own index. In doing so, I riffed on its private equity holdings, which had had little apparent effect on XOVR’s performance last year.

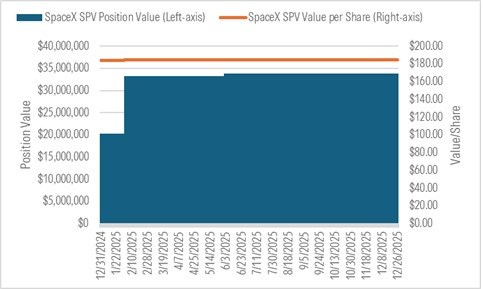

This is strange for a pretty basic reason: XOVR has owned a good-sized slug of SpaceX (via a special purpose vehicle, or “SPV”; blue bars below) since Dec. 2024 and SpaceX’s valuation mooned over that period (red line).

Given that, you’d expect the ETF to have seen at least some benefit from its private equity stake. But that doesn’t appear to be the case.

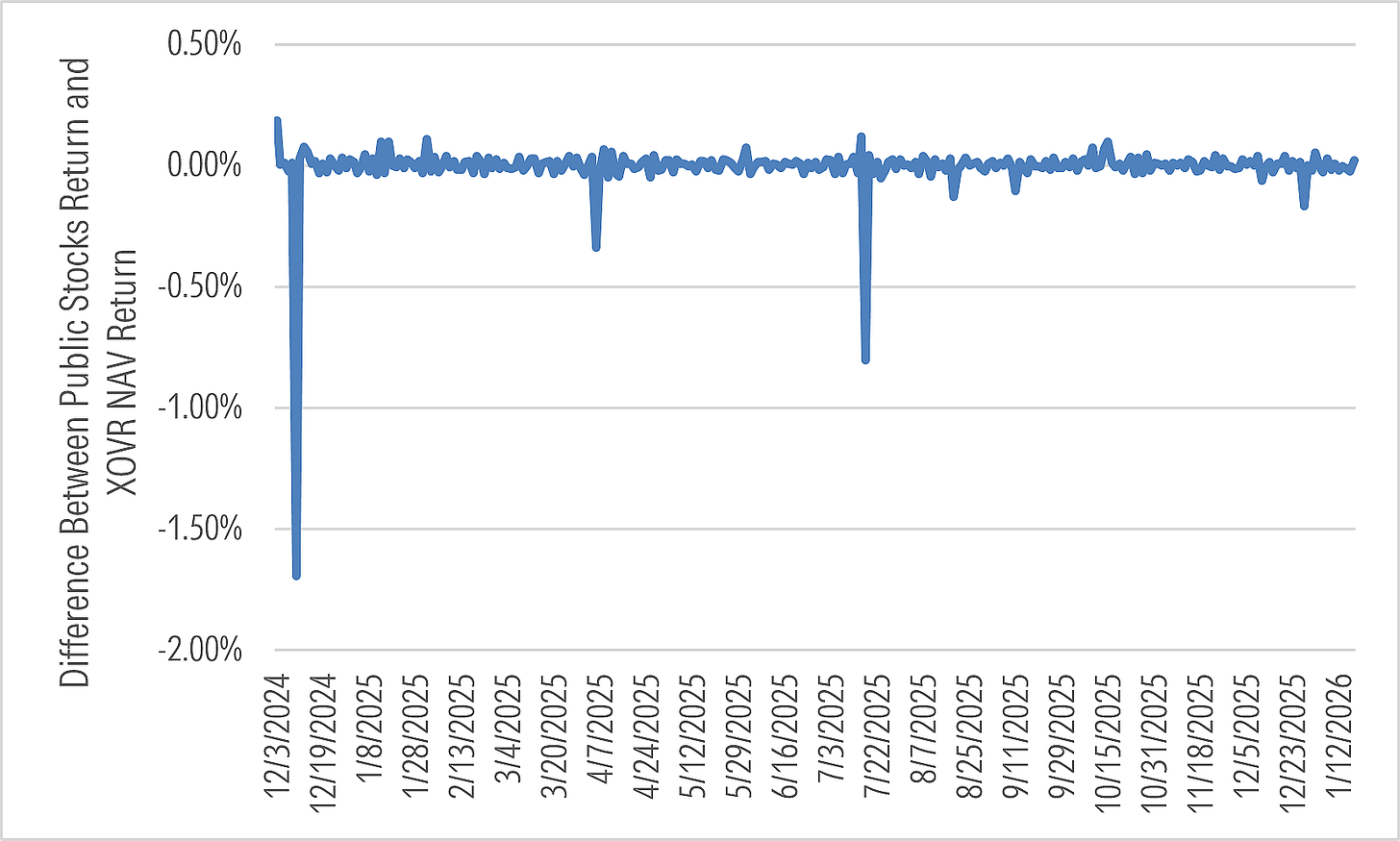

To illustrate, I used the daily weights and returns of XOVR’s public equity holdings to try to reconstruct its daily total returns at NAV. If there’s a large difference between them, it would suggest its private equity stake was also driving returns. But the public holdings’ daily returns closely approximates XOVR’s daily returns from the time the ETF initiated its SpaceX SPV stake through Jan. 16, 20261.

In other words, the ETF’s public stock holdings have seemed to almost entirely account for its returns2.

And so the question is why.

A Brief History of XOVR’s SpaceX SPV Position

Mechanically, the reason seems to be the manager didn’t change the ETF’s SpaceX SPV mark last year. They brought it into 2025 at a $185 per share carrying value and it didn’t budge until Dec. 30, when they wiped the share count and fair value per share from their reporting.3

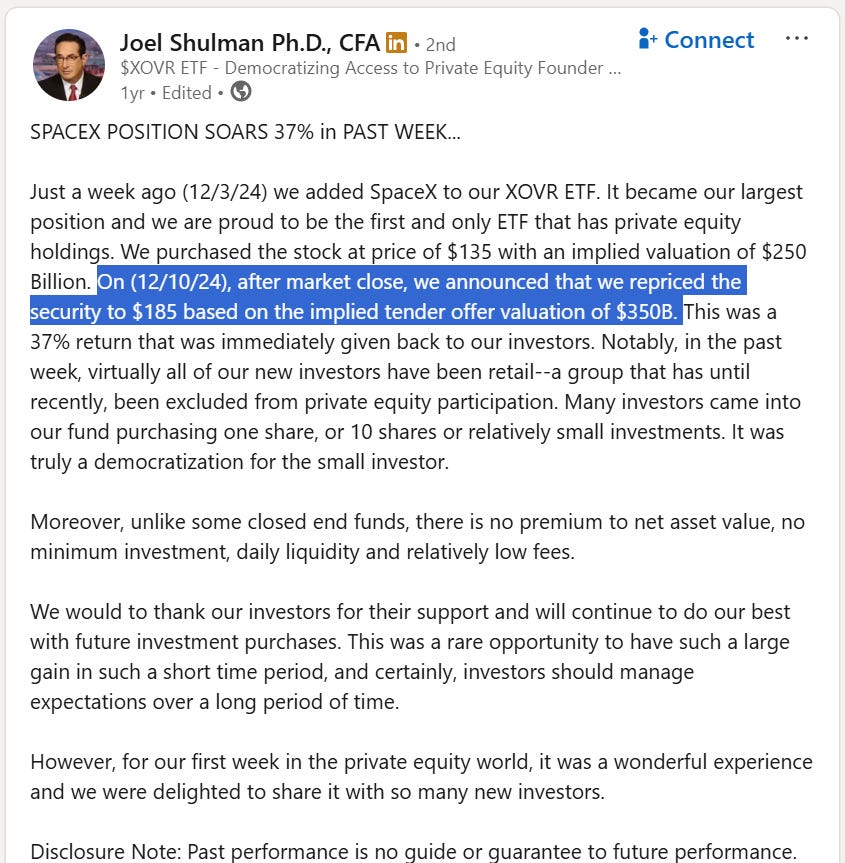

Here’s a fuller chronology of the SpaceX SPV position, dating back to when XOVR first entered it. Where possible, I’ve linked to public statements the manager made at or around the relevant times, including comments where the firm cited or hyped the $185/share valuation (before later distancing itself from that mark).

Dec. 3, 2024: (“Astra Holdings SPV LP”) | 55,556 shares at $135/share = $7.5M

Dec. 10, 2024: (“Astra Holdings-SpaceX LP”) | 55,556 shares at $185/share = $10.3M

Dec. 13, 2024: (“SpaceX, SPV”) | 109,610 shares at $190/share4 = $20.8M

Jan. 31, 2025: (“SpaceX, SPV”) | 179,880 shares at $185/share = $33.3M

June 2, 2025: (“SpaceX, SPV”) | 182,583 shares at $185/share = $33.8M

Dec. 30, 2025: (“SPV Exposure to SpaceX”) | $161.5M (sharecount and carrying value/share removed)5

“Transparency Reset”

Which brings us to Tuesday, when the manager announced it had hiked XOVR’s SpaceX SPV stake by another $77.2M (to $238.7M) and “completed a one-time reset of the fund's private-asset structure to improve transparency of forward-looking performance attribution for investors.”

As part of that announcement, the manager disclosed it was valuing SpaceX at $526.59 per share, which was the most recent tender offer price, and had “completed a one-time net asset value (NAV) adjustment associated with converting legacy private-asset arrangements into a simplified structure aligned on an effective "0/0" basis.”

Which…wait…what…?

Let’s start with the $526.59 per share mark. That’s almost triple the previous $185 per share value XOVR was carrying its SpaceX SPV stake at. Given that, you’d expect the ETF’s NAV to have leapt higher, reflecting the mark-up from the $185 per share value at which they had been carrying at least a portion of the stake6. But it doesn’t appear to have.

XOVR gained 3.3% (on a NAV basis) on Monday, Feb. 9, the day this “transparency reset” apparently took place. When I multiplied the ETF’s public stock holdings’ estimated weights entering Monday by their returns that day, it nearly matched the ETF’s return. That suggests the SpaceX SPV had contributed minimally to performance that day and the same has been true in subsequent days, best I can tell.

In summary, there was little evidence the manager changed the ETF’s SpaceX SPV mark from Dec. 2024 through mid-Jan. 2026 (i.e., the public stock holdings’ returns explained XOVR’s NAV returns over that period). And there doesn’t seem to be much evidence the ETF’s returns got a boost from this “transparency reset” (see paragraph above). Which makes no sense if they’re saying the position is now worth…$526.59 per share.

NAV Adjustment

Then there’s the other piece: The “one-time net asset value (NAV) adjustment.” What this seems to be referring to is efforts the manager made to simplify the nested SPV structure it was apparently using to obtain exposure to SpaceX shares. As part of this, they’re now footnote disclosing how much of the “SPV Exposure to SpaceX LLC” line item is in cash (~$33M) versus actual “exposure to SpaceX” (~$205M).7

That aside, how much did the manager adjust XOVR’s NAV by on Feb. 9? I don’t see any evidence they materially adjusted it. As mentioned, I was able to reconstruct XOVR’s return that day using its public stock holdings’ weights and returns, which wouldn’t have been possible if they’d made a significant NAV adjustment. Moreover, the NAV returns in recent days approximate XOVR’s market returns.

Given that, I think the NAV adjustment is probably kind of a nothingburger8.

Come Clean

That said, it’s hard to avoid the sense that what XOVR’s manager is really seeking is a do-over. As if to say “About the last fourteen months…when we heavily touted and sold on XOVR’s SpaceX exposure…and carried it at a value that’s a fraction of the mark we just made…yeah let’s just get past that and start again.”

How else to explain the incongruousness of the situation, where XOVR’s investors appear to have accrued minimal benefit from a large position that went parabolic. For all the manager’s attempts to cast it as a “reset”, it seems like there are only a few possible explanations for the present circumstances:

They got crushed by fees

They got massively diluted

Either way, absent some better explanation, it sure seems like the manager misrepresented the economic substance of XOVR’s participation in SpaceX equity.

To step back for a minute, the only logical reason investors converged on XOVR to begin with is for the SpaceX exposure it purported to offer. They’re certainly not there for the ETF’s performance, which was pedestrian before it took the SpaceX SPV position on Dec. 3, 2024, and has been dismal in the time since.

Given that, the manager should dispel these questions by providing a full, precise accounting of XOVR’s SpaceX investment over time and the benefits it conferred to shareholders. This has become more urgent amid a recent spate of outflows—by our estimates nearly $400 million just in the past two days—which has pushed the SpaceX SPV’s weight above 18% of net assets.

Come clean, ERShares. It’s the least you could do.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.

The ETF has not reported its holdings to Morningstar since Jan. 16, 2026.

The exceptions were as follows: December 2024 (this is the only mark-up of the SpaceX SPV position fair value that we’re aware of, from $135 per share to $185 per share); April 2025 (this is a modest difference, unexplained by a change to the SpaceX mark which remained the same throughout this period); July 2025 (this was a rebalancing date for the public-stocks sleeve).

Footnote disclosure on the ETF’s website lays out the rationale for removing the share count and carrying value: “Private Securities generally have no CUSIP, are not unitized, and therefore do not have a quoted share price. These investments do not have readily available market quotations and are fair valued in accordance with the Fund’s valuation policies and procedures, typically using net asset value or other methodologies permitted under applicable accounting standards.” Notwithstanding that, the manager had cited and hyped the $185 per share carrying value on multiple occasions, as detailed above.

It is not clear why the manager valued the position at $190 per share for a brief time. It reverted to $185 per share shortly after.

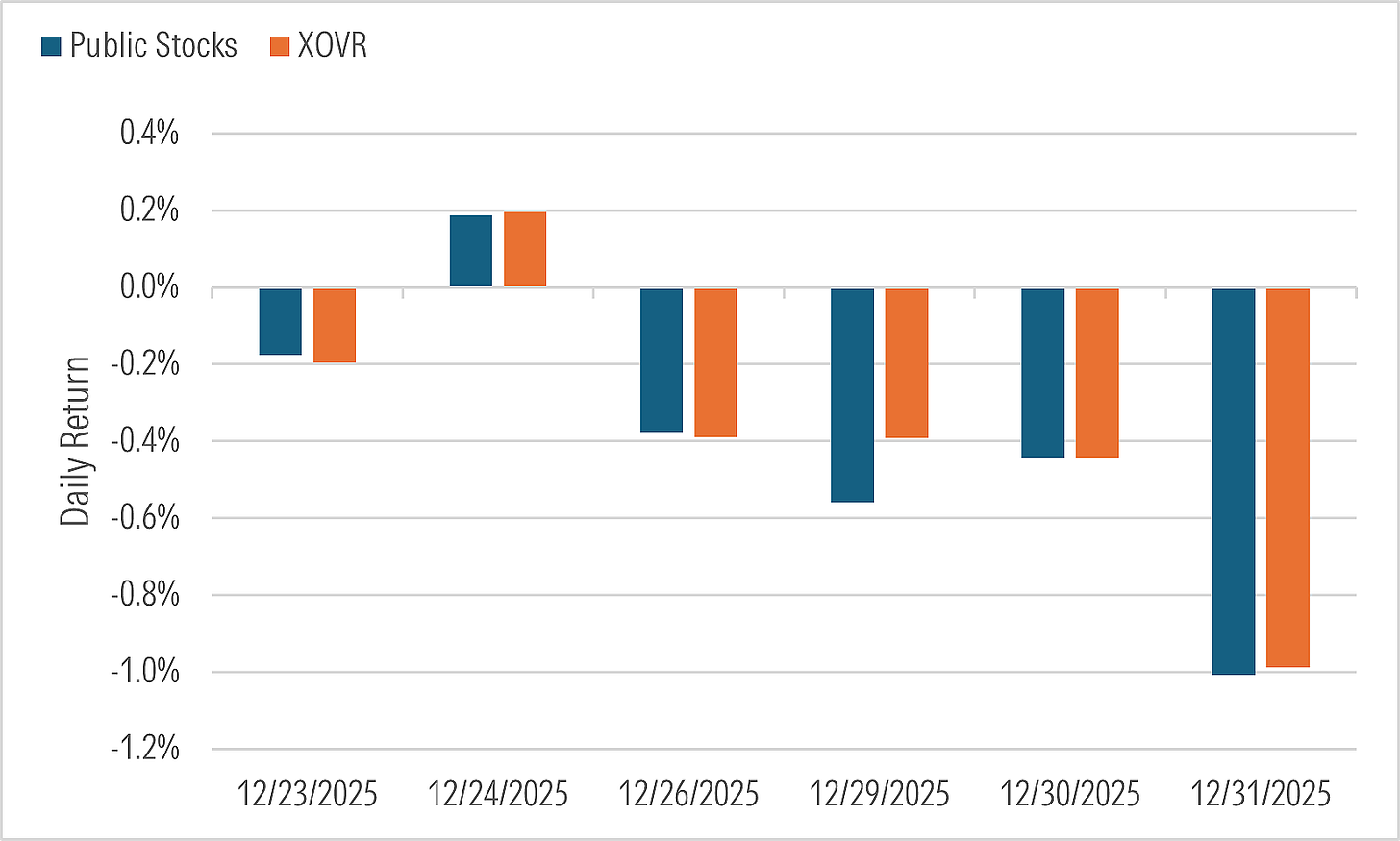

Note that when when the manager hiked the ETF’s stake on Dec. 30, 2025, it doesn’t appear they changed their mark. Had they done so, we’d have seen a meaningful gap between the ETF’s return that day and the aggregate estimated return of its public stock holdings. But that wasn’t evident in the days preceding or following Dec. 30, during which the aggregate return of the ETFs’ public stock holdings more-or-less mirrored the ETF’s NAV return, as shown in the chart below.

Because the manager stopped reporting share count and carrying value in Dec. 2025, we don’t know what price they paid when they made additional SpaceX SPV purchases in Dec. 2025 and again in Feb. 2026. All we know is they were reporting a $185 per share fair value with respect to the $33.8M in SpaceX SPV they were carrying into the date they discontinued that reporting. As such, it stands to reason that at least that $33.8M portion of the stake should have seen a mark-up to the updated $526.59 per share fair value.

“As of 2/9/2026, the Fund holds approximately $205 million of exposure to SpaceX through an effective “0/0” structured vehicle. The value is based on the SpaceX corporate announcement on 2/2/2026 that values the company at approximately $1 trillion (corresponding with a $526.59 stock price value). The Fund expects to maintain additional net assets in cash or cash equivalents in the SpaceX SPV to support portfolio liquidity, facilitate opportunistic investments, satisfy redemption activity, fund potential capital calls, and meet operating expenses and other obligations. There is no assurance that such capital will be deployed or that any investments will achieve their intended objectives. Maintaining cash positions may, at times, create a temporary performance drag during periods when such assets are not invested; however, the Adviser believes such flexibility supports prudent portfolio management. The Fund’s cash allocation is established within the Adviser’s liquidity risk management framework and is designed to preserve operational flexibility while supporting compliance with applicable regulatory expectations and maintaining prudent portfolio construction. The Fund’s cash allocation may vary from these levels based on market conditions, transaction timing, and portfolio management considerations.” (Source: ERShares)

It’s possible these words will come back to haunt me, but my suspicion is that “NAV adjustment” in this context is referring to a change they’re making in how they account for the SPV investment itself. It is possible that they formerly valued it net of something akin to a minority interest the SPV manager had in the investment pool and now they’re assuming the fund has a 100% interest and reducing the per unit value by a corresponding amount. In that case, the net value of that investment wouldn’t change, nor would XOVR’s NAV itself, though it still qualifies as a “NAV adjustment”. Hence, nothingburger.