Doesn't Track

ERShares Private-Public Crossover ETF's (XOVR) performance is puzzling

I’ve already written about ERShares Private-Public Crossover ETF (XOVR) a few times. Once here and another time, at greater length, on Morningstar.com.

It’s a pretty obscure ETF*, so why bother? Couple reasons. They’re attempting to invest in public and private equities in an ETF and thus the process they follow in doing so is worth assessing. Also, they’ve gone about it in a slapdash way that raises many questions in my opinion.

But for as much attention as I’ve paid to XOVR, there’s one thing I’ve glossed over: The portfolio’s public sleeve, which is “informed by and aligned to” a rules-based index the manager developed. That index, called “ER30TR”, consists of the stocks of firms that exhibit a “high entrepreneurial profile.” The ETF’s prospectus describes the index rules as follows.

The Index methodology ranks all companies that have passed both screens by market capitalization. The largest 30 companies by market capitalization are selected, and their common stocks are equally weighted to create the 30 constituents of the Index. The Index is rebalanced and reconstituted on a quarterly basis (following the close of trading on the second Friday in March, June, September and December).

I have not been able to track down a publicly available methodology for the index (I’ve asked for one, to no apparent avail so far) so the above is as much as we have to go off of. But a few things seem worth noting:

Best I can tell, XOVR’s public sleeve has never been equally weighted.

It doesn’t appear XOVR’s public sleeve was rebalanced in March, June, September, and December as specified, but rather April, July, and October of 2025, and January 2026.

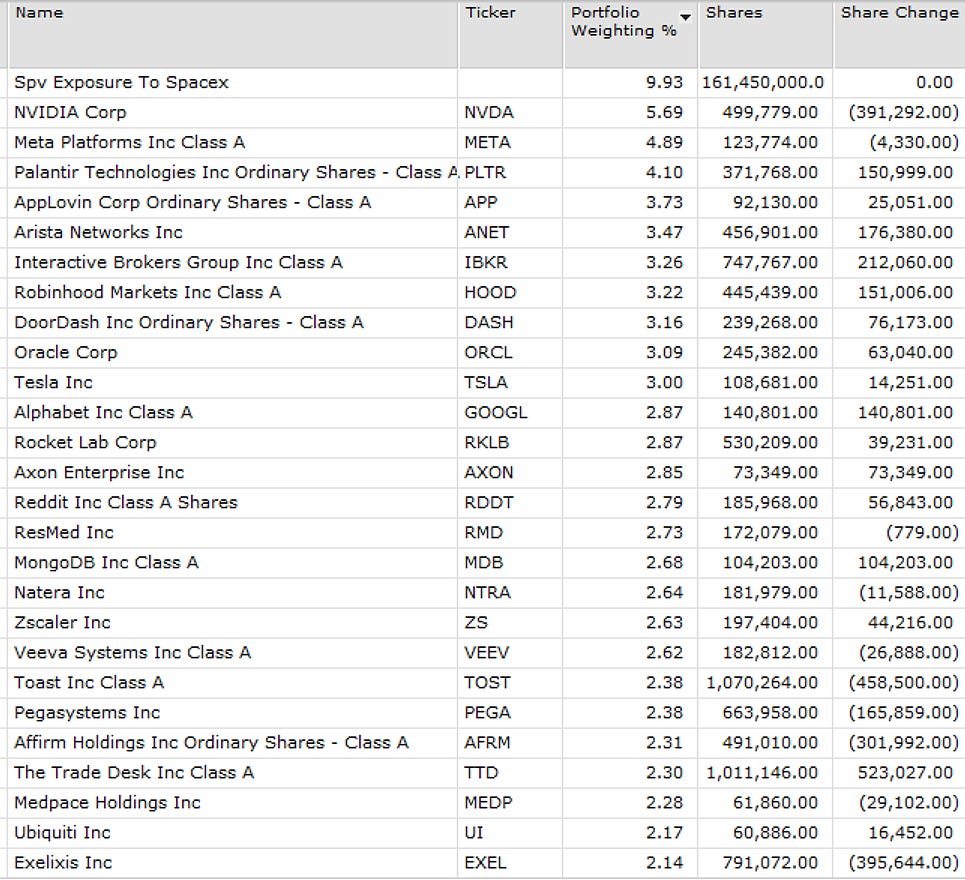

For instance, here’s what the portfolio looked like on January 12, 2026 following what appears to be a rebalance (judging from the prevalence of share changes and the addition of a few names and deletion of several others).

You could argue that when you use terms like “informed and aligned” it affords you a certain leeway in following the index’s rules. But the manager also states in the website’s fine print that it “invests…in the index” (“invests primarily (85%+) in the ER30TR Index (30 securities) and the balance in US Large Cap private securities”).**

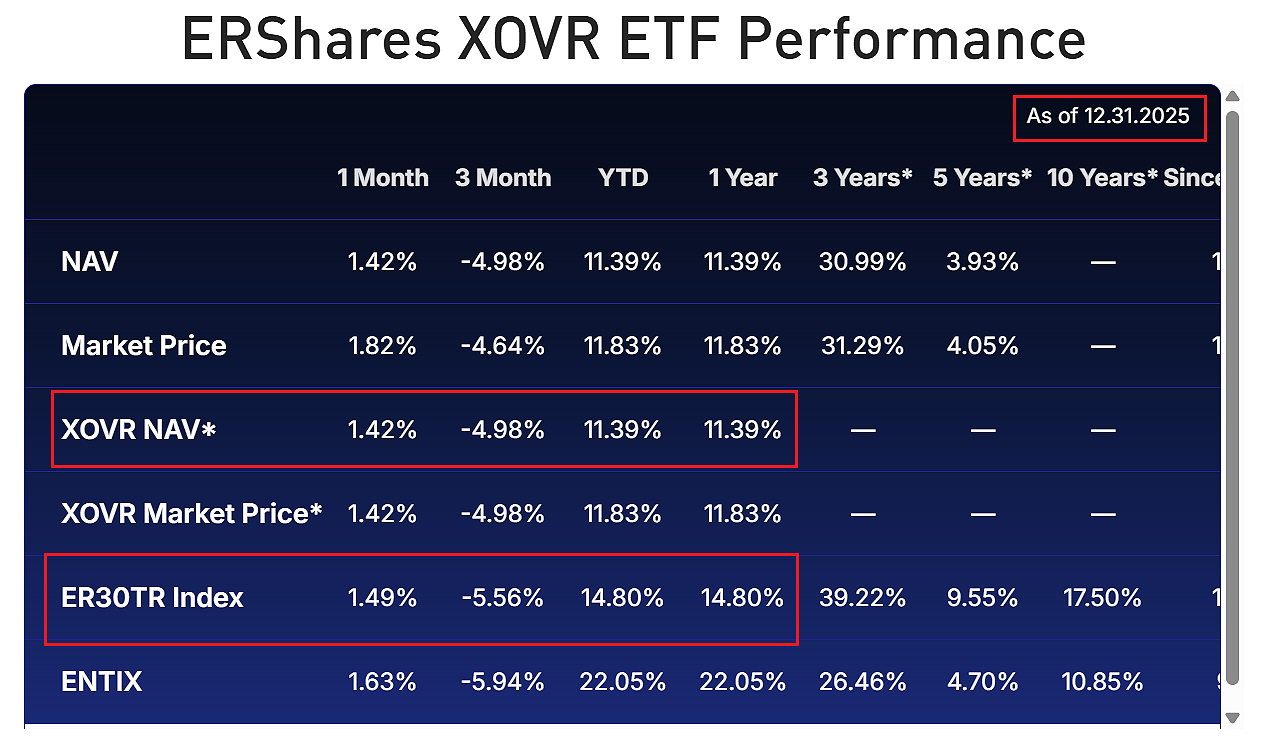

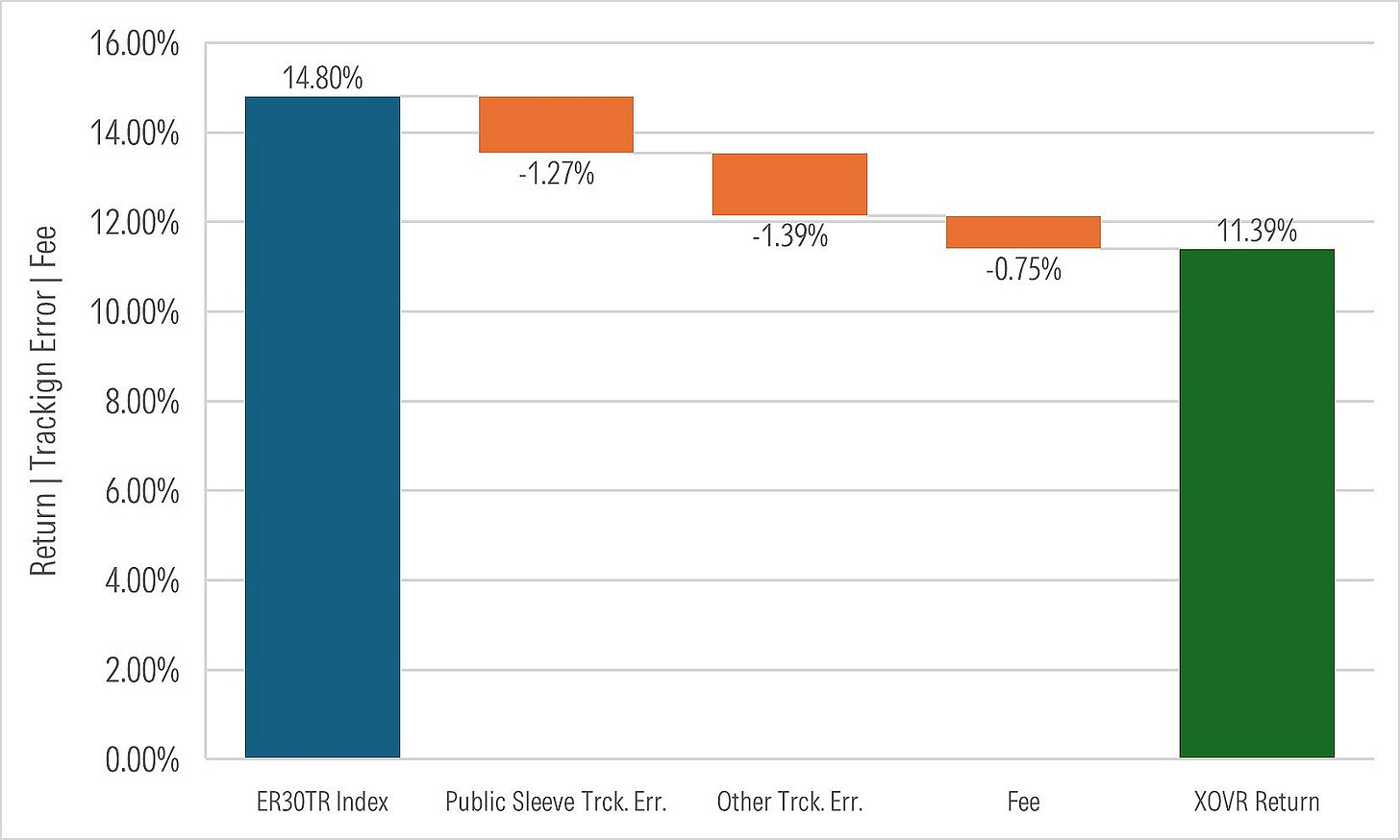

Unfortunately, there’s no way to determine the extent to which XOVR’s holdings might have deviated from the index’s, as I can’t seem to find the index’s holdings anywhere. What we do know, though, is XOVR has lagged the index by far more*** than its 0.75% expense ratio.

All told, XOVR lagged the ER30TR index by around 340 basis points after fees last year. Once we account for its 0.75% fee, that leaves 2.65% of unexplained tracking error.

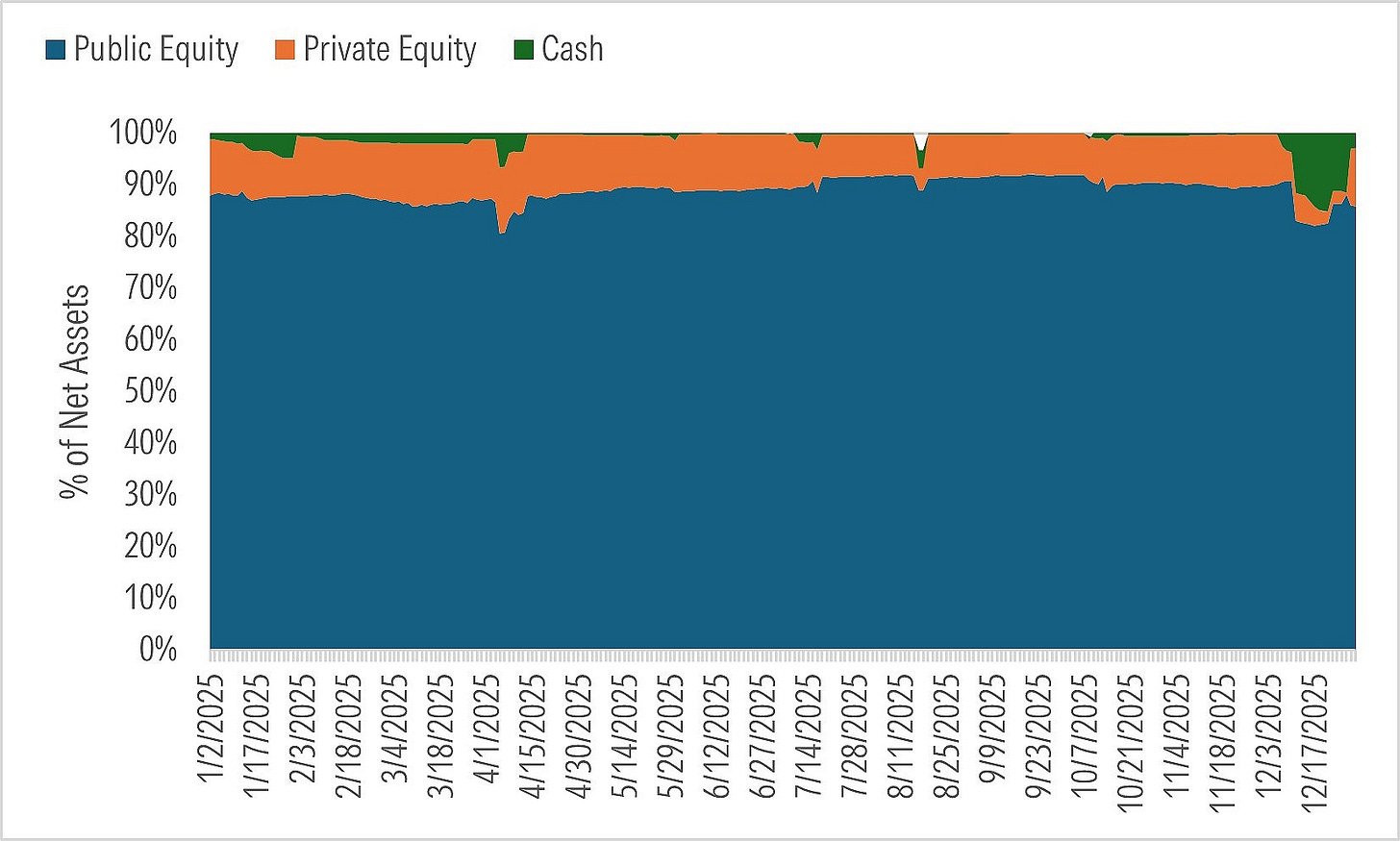

What could explain that shortfall? One possible culprit is XOVR’s stake in private equity and cash. If that sleeve didn’t gain as much as the ETF’s public stock holdings, then that could explain some or all of the tracking error. However, I estimate the ETF’s private equity and cash holdings accounted for only around 11% of its assets, on average, in 2025.

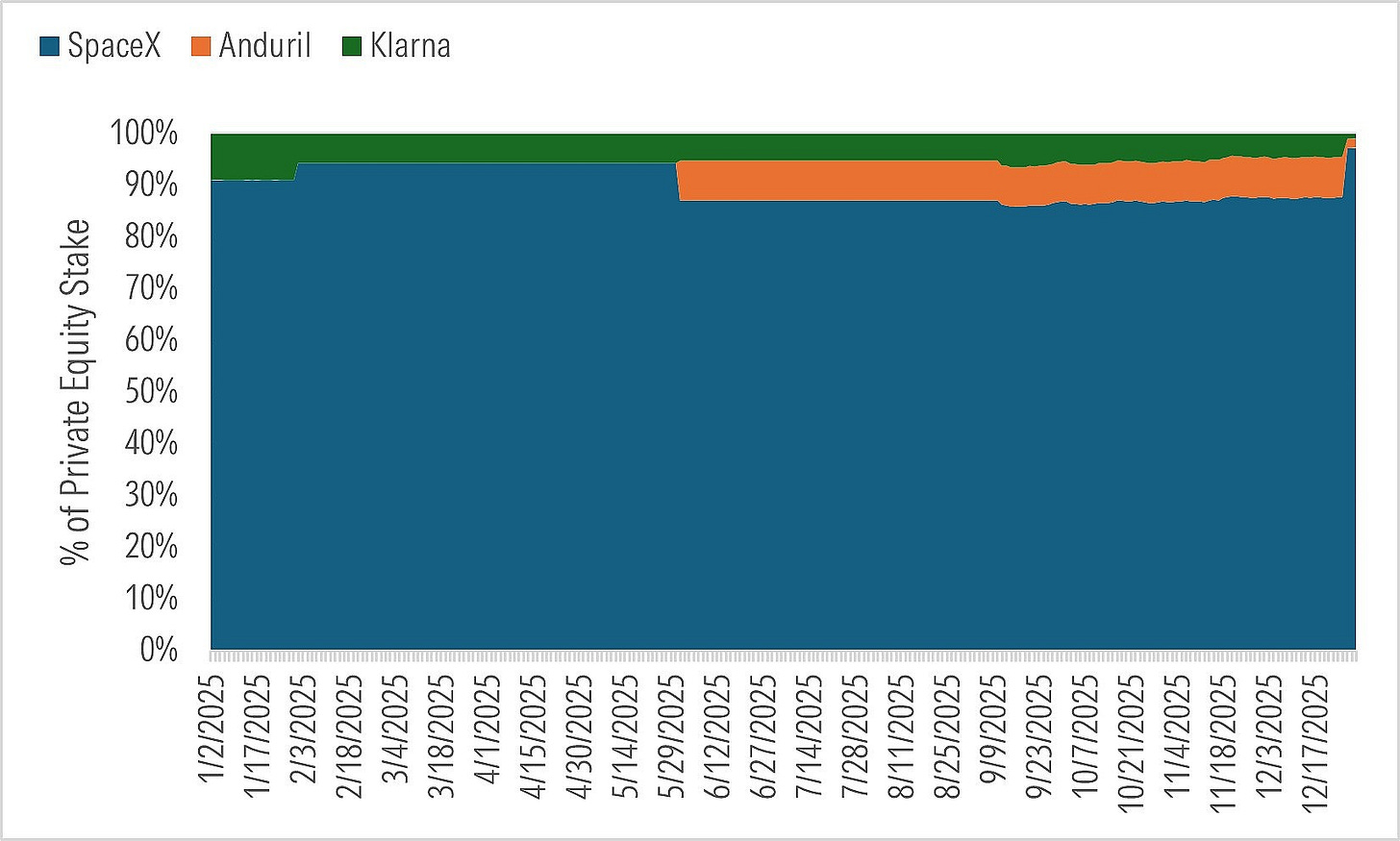

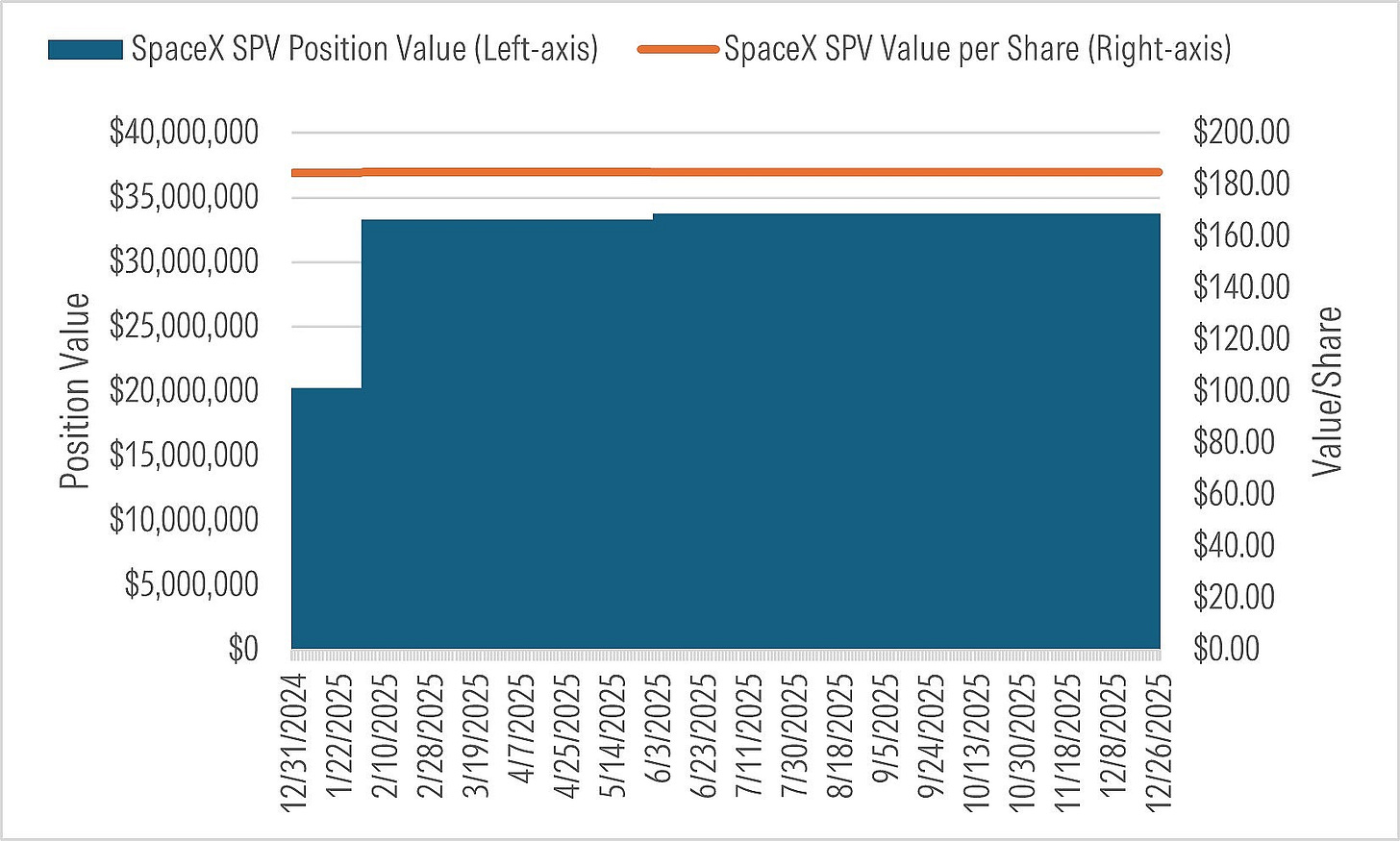

The only way such a small stake could explain the tracking error to the index is if those private investments lost a lot of value last year. As a practical matter, we’re really talking about SpaceX—most of XOVR’s private-equity stake was tied up in a SpaceX special purpose vehicle (SPV) as shown below****.

As far as I can determine, the manager didn’t mark the SpaceX SPV position higher or lower last year: It carried it at a $185/share unit value throughout. (On Dec. 30, 2025, the manager increased its stake in the SpaceX SPV and removed the sharecount, making it impossible to ascertain the value at which they’re carrying the position.*****)

So if we assume the private investments and cash were not a big factor, then we have to consider the public-stock sleeve itself. Using the ETF’s reported daily net returns and its daily aggregate percentage weight in public equities, I estimate that sleeve gained around 13.5% before fees****** in 2025. That would be about 1.30% less than the index’s return last year.

Yet, that still leaves another 1.4% of tracking error unaccounted for. Where’d it arise from? I don’t know.

Whatever it is, it doesn’t track.

Footnotes

* It’s less obscure these days, though, as it saw a spurt of inflows towards the end of last year and so was recently sitting on around $1.6 billion in net assets.

** Despite this, the manager indicates elsewhere the index is not investable: “The ERShares ER30TR Index selects the most entrepreneurial, primarily US Large Cap companies, that meet the threshold embedded in the proprietary Entrepreneur Factor® (EF). It is not possible to invest directly in the Index…“

*** Adding to the confusion, it appears that for a period of time the manager posted a different set of returns for the index on its website. They have since corrected the apparent discrepancy. Here’s a screenshot of the erroneous data while it was still posted.

**** XOVR’s Anduril and Klarna stakes are too small to move the needle. XOVR initiated its position in an Anduril SPV in June 2025 and was slightly underwater as of Dec. 31, 2025 (5.7% loss). It held a Klarna SPV throughout 2025 and thus participated in the IPO. However, because the ETF apparently didn’t/couldn’t exit the position post-IPO, it rode KLAR lower in the time since. As of Dec. 31, 2025, I estimate the position had lost more than 15% of its value. All told, I estimate XOVR had recorded only around $1.5 million in net appreciation on its $100 million-plus outlay on private investments and Klarna as of Dec. 31, 2025.

***** XOVR’s site explains this decision as follows: “Private securities that are private funds have no CUSIP, are not unitized and thus have no “share price.” Such investments have no market price and are fair valued, generally at net asset value.” This despite the fact that the ETF’s manager had previously cited the position’s $185/share “price” in a LinkedIn post in which he hyped a mark-up they’d recently made. He referred to the investment as a “stock”, not a SPV, though XOVR appears to have always obtained SpaceX exposure through an SPV, not direct share ownership.

****** I was able to largely reconstruct the daily returns XOVR earned from its public-stock holdings using those stocks’ daily weights and reported returns. Essentially, I took each stock’s return each trading day, multiplied it by its weight entering that day, and then summed those products to arrive at an estimated return for the portfolio’s public sleeve that day. I compared that to the estimated daily public-sleeve return I’d derived by dividing XOVR’s daily net return by its aggregate public equity weight that day and then grossing up that amount by the fees levied that day. In general, the reconstructed daily returns closely approximated the daily returns I derived by dividing the ETF’s daily net return by its public equity weight.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.