Today in "That Seems Kind of Weird But Maybe It's Normal Now and So I'm the Weird One?"

SpaceX as a big weight in a daily liquidity fund. Cool, cool.

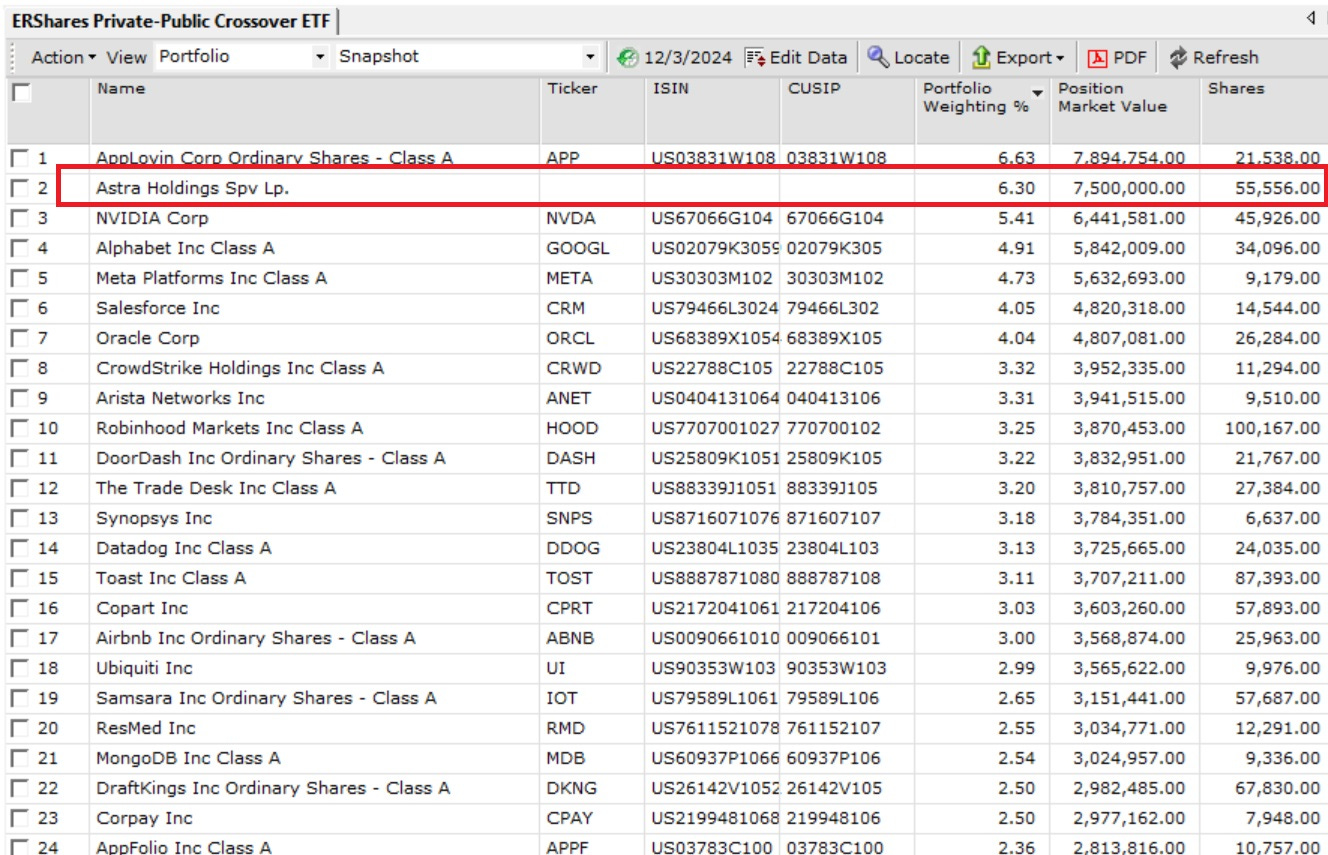

There’s a small ETF that’s taken kind of a chunky position in SpaceX. As of yesterday, it was a 9.1% weight in ERShares Private-Public Crossover ETF (Ticker: XOVR). H/t to Bloomberg’s Eric Balchunas for pointing it out in a tweet yesterday.

SpaceX is private. The ETF is a daily liquidity vehicle, i.e., open-end and so money comes, money goes. While there’s a “market” for SpaceX shares and it is owned by some other funds, we have not really seen an ETF take a big position in it like this fund has. (The only open-end fund that’s done so is Baron Partners, which was recently sitting on a roughly 13% SpaceX stake.)

What happens from here is likely to turn on demand for the ETF. It’s been attracting inflows because it’s one of the few public conduits to SpaceX. If the inflows continue and the fund can’t get more SpaceX shares the position will shrink as a percentage of assets. This would be good in that it would mitigate the risk of a liquidity mismatch (i.e., private holding in a public wrapper). It would be bad in that the inflows are being stoked by demand for SpaceX, demand the fund would find it increasingly difficult to meet as the position shrank as a percentage of assets.

We also have to consider the opposite scenario, where demand dries up or even reverses. That would be good in preserving the fund’s ability to maintain a meaningful percentage stake in SpaceX (assuming none sold), which is what some investors would prefer. But it would be bad if the fund’s public holdings shrank around the SpaceX position (i.e., if they were sold to meet redemptions), potentially making SpaceX a bigger piece of the pie and further accentuating risk of a liquidity mismatch.

This isn’t totally academic to me. I wrote a long piece a few years ago about an open-end fund that loaded up on a private firm, called TerreStar (now Midwave Wireless) and found itself unable to meet redemptions. They ended up converting it to a closed-end fund but it was really messy and performance has been terrible.

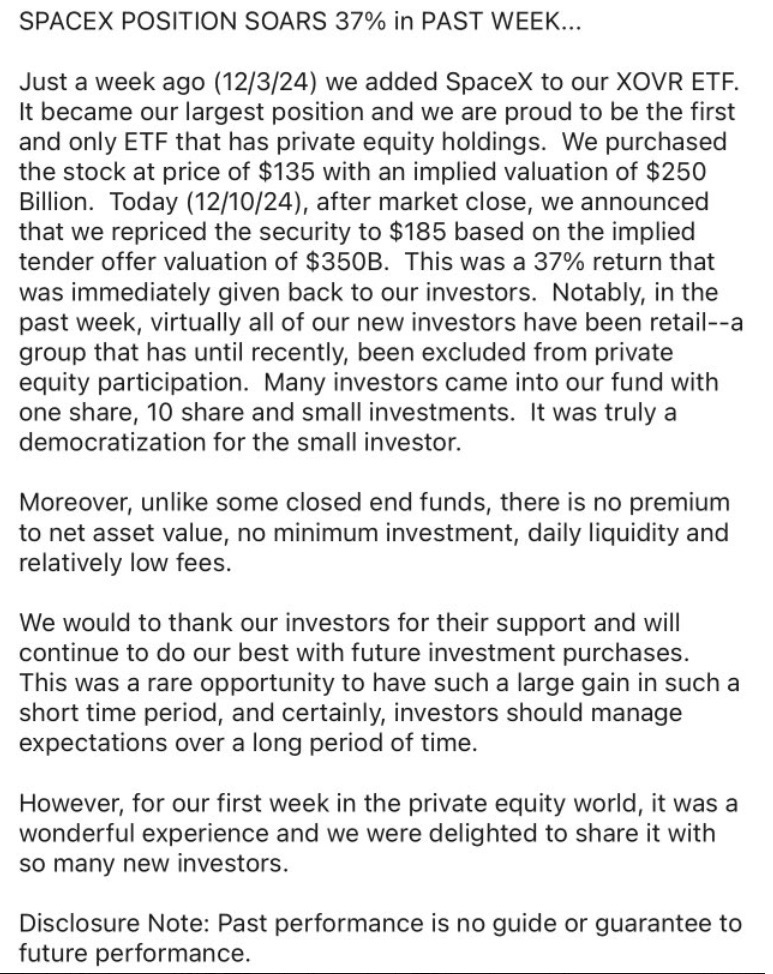

I wouldn’t expect that kind of extreme outcome in this case but there are a few things that give me pause. For instance, there’s the firm’s press release heralding the addition of SpaceX to the ETF’s portfolio, in which the firm mentions it had recently marked the position up by 37%.

Putting aside the fact that it’s kind of odd for a firm to brag about short-term moves in individual positions it’s taken (let alone positions where it plays a direct role in valuing the security concerned), there’s also the circumstances: It appears the fund initiated its SpaceX stake on December 3, 2024. which is when a holding named “Astra Holdings Spv Lp.” appeared for the first time in its portfolio, as shown.

The fund carried the position at the same value through December 9, 2024, at which point it renamed it “Astra Holdings-Spacex Lp” (at least that’s how it appears in our database). On December 10, the fund marked the position up to $185/share from $135/share the day prior, which is apparently where the 37% price appreciation reference came from. Then on December 13, the fund reported it had nearly doubled its SpaceX stake, which it now labeled “Spacex, Spv” in our database. It has remained at the same carrying value ever since.

It’s certainly possible that SpaceX’s fair value rose 37% in a week and then flatlined in the days since. One of the firm’s backers laid out the rationale as follows in this tweet.

I have no way of knowing if those marks are accurate or not. But when you take uncertainty about the position’s fair value together with its size in percentage terms—like I said, most of the time you see private securities in public wrappers they’re smallish weightings—it can get kind of hairy.

The market will ultimately be the judge of that and if it has reason to doubt the marks then that will express itself in the price. But with such strong demand—and indeed the ETF has more often traded at a premium than a discount lately—one is left to wonder if investors are simply willing to trade the uncertainty associated with SpaceX’s value for access, keeping the ETF’s price in line with NAV more-or-less.

The other aspect of this that gives me some pause is what can seem like a lack of forethought by the sponsoring fund company. To be fair to them (who it should be noted I wasn’t familiar with until yesterday), I am not privy to the deliberations, conversations, and planning that might have gone into the decision to initiate and build the stake in SpaceX. But when you see tweets like this and this—in which one of the ETF’s backers speaks of “managing flows” and of an “active secondary market” in SpaceX shares, respectively—you really wonder.

Unless the ETF stops doing creates, there is no “managing flows.” The ETF is listed so you can’t turn off the demand. Moreover, talk of an “active secondary market” in SpaceX is rather meaningless unless you see evidence of it, i.e., more frequent and meaningful marks of the position’s value. As I mentioned before, apart from the 37% mark-up they did, there have been no marks at all.

(There are also issues of fairness. Every other comparable fund and ETF making daily marks to their book will exhibit a greater variability of returns than will an ETF that is effectively not marking one of its largest positions. It’ll look less volatile.)

It’s not to dump on this fund or fund company. They’re providing a service to willing buyers. But as talk of public/private convergence heats up, the temptation to stuff daily liquidity funds with private securities will become even harder to resist. Judging from what I’ve seen so far, they should hold the line and say “no”.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.