Vanguard's Jack Bogle Was Right (Again)

It looks like investors in equity ETFs--Vanguard's included--are over-trading and it's costing them.

For the record: I own ETFs. I think they’re useful, especially for taxable money. I love low-cost investing. So consider me an ETF devotee.

But I’d like to think I’m also cleareyed about the risks they can pose to those who can’t resist trading them. People will overdo it and indeed that’s why Vanguard founder Jack Bogle wasn’t a fan. It was Bogle who likened ETFs to a shotgun, pejoratively describing them as “great for big game hunting in Africa, but also great for suicide.”

With Bogle’s warning in mind, I decided to take a look at the dollar-weighted returns of equity ETFs over the decade ended Jan. 31, 2025. The ETFs’ estimated dollar-weighted return would yield a sense of how well ETF investors had done after taking the timing and magnitude of their trading into account. If Bogle was right, then you’d expect stock ETFs’ dollar-weighted returns to lag their time-weighted returns.

As I lay out in further detail below, it looks like he was right: Investors in stock ETFs’ appear to have over-traded, missing out on a big chunk of the ETFs’ total returns. In fact, based on my estimates, it appears the average dollar invested in traditional stock mutual funds outgained the average dollar in equity ETFs over the ten-year period.

Total Return

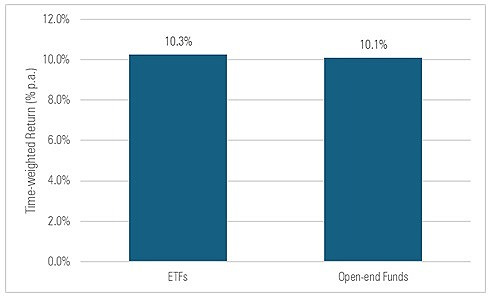

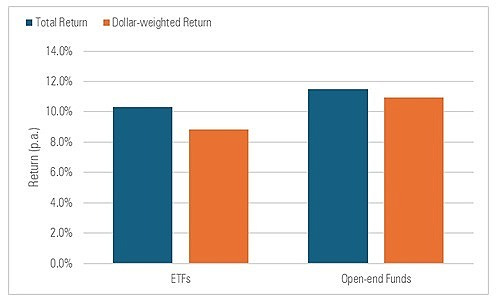

Let’s unpack this, starting with equity ETFs’ and equity mutual funds’ time-weighted, or “total”, returns. This is the familiar “buy-and-hold” return in which we assume a lump-sum investment is made at the beginning of the time period (Feb. 1, 2015) and left untouched until the end (Jan. 31, 2025).

Since I wasn’t looking at a single ETF or fund but rather thousands of them, I aggregated the funds and ETFs at the beginning, weighting each by its assets as of Feb. 1, 2015*. Then I compounded the aggregate’s value based on the reported monthly total net return for each ETF or fund through Jan. 31, 2025. The difference between the aggregates’ beginning and ending values is the time-weighted return.

The stock ETFs win by a nose: Their aggregate time-weighted return topped the stock mutual funds’ by around 0.2% per year.

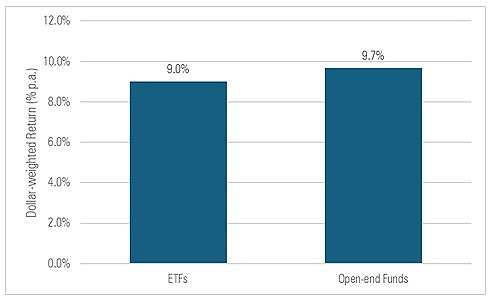

Dollar-weighted Return

Next, I estimated each aggregate’s dollar-weighted return, aka “internal rate of return”. For this calc, it’s a matter of pooling all of the ETFs’ and funds’ initial assets, their monthly net flows, and then their ending net assets. Once you’ve got that, you can run an IRR and estimate what the average dollar earned, which is what I did.

On this basis, stock ETFs fell short: Their average annual dollar-weighted return lagged that of equity mutual funds by around 0.7% per year.

Whereas investors in equity mutual funds captured nearly all of the funds’ returns (i.e. their 9.7% per year dollar-weighted return was equivalent to around 96% of the 10.1% time-weighted return those funds earned, in aggregate), investors in stock ETFs frittered away about an eight of those funds’ returns (i.e., their 9% annual dollar-weighted return represented about 88% of those ETFs’ 10.3% total return).

Overdoing It

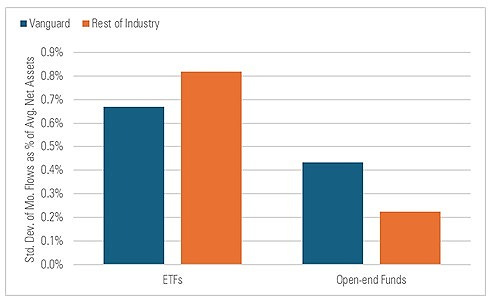

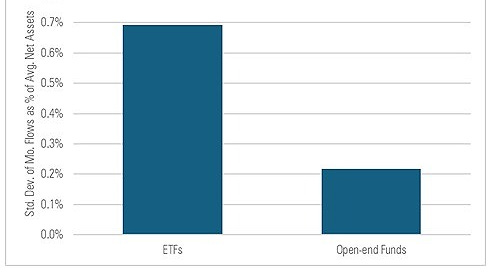

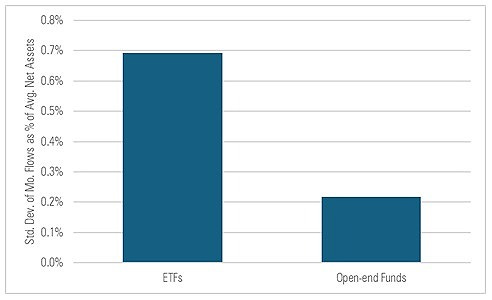

Why didn’t stock ETF investors capture more of their returns? It appears they traded far more often than investors in equity mutual funds did. Specifically, the standard deviation of equity ETFs’ monthly net flows (as a percentage of their average net assets over the ten years ended Jan. 31, 2025) was more than twice as high as the volatility of flows to stock mutual funds, as shown below.

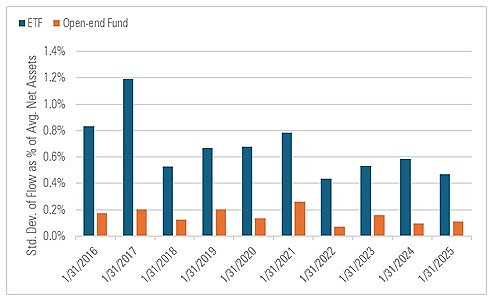

And it doesn’t appear that it’s been a matter of ETF investors trading like wild in a stray year or two. Rather, when I looked at the year-to-year flow volatility (for each twelve month period ended Jan. 31), stock ETFs’ had a higher standard deviation of monthly flows than equity mutual funds in all ten years.

What About Vanguard?

Did that pattern hold for Vanguard’s equity ETFs and open-end funds? The monthly flows to their stock ETFs were less volatile than the rest of the industry, but not by a lot, while the flows to their open-end funds were actually a bit more volatile than other funds.

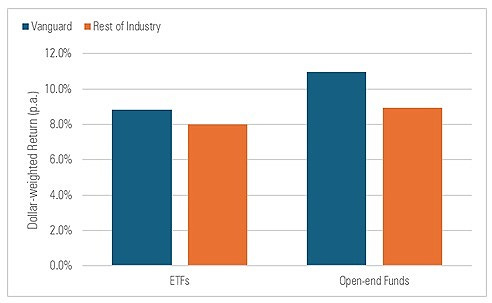

Given this, how did the average dollar invested in Vanguard stock ETFs and open-end funds perform when compared to the average dollar invested in other ETFs and funds? Here’s what what the dollar-weighted returns for the ten years ended Jan. 31, 2025 looked like:

It’s likely Bogle would be pleased to see this. Whether investors chose a Vanguard equity ETF or an open-end stock fund, their average dollar outgained the average dollar invested elsewhere. So far so good.

But it’s also possible that this next chart would have gotten him riled up. It shows that while investors in Vanguard equity strategies earned higher dollar-weighted returns than other investors, they still missed out on a chunk of the ETFs’ total returns.

I estimate the Vanguard stock ETFs earned a 10.3% aggregate annual total return over the decade ended Jan. 31, 2025 but the average dollar gained only 8.8% a year, suggesting that about 15% of the buy-and-hold return was lost to inopportunely timed purchases and sales. (The shortfall is even wider for the rest of the industry, though.)

The main reasons the average dollar in Vanguard’s stock ETFs and funds earned more than the average dollar invested elsewhere are:

The ETFs and funds earned a higher aggregate total return (11.3% per year vs. 9.9% vs. the rest of the industry); and

Vanguard’s investors captured a bigger portion of that return (10.3% per year, which represents 92% of the 11.3% buy-and-hold return) than did other investors (8.7% per year, 87% of the 9.9% total return).

Conclusion

Jack Bogle warned “ETFs are the greatest trading innovation of the 21st century, but not the greatest investment innovation.“ Once again, his words seem prophetic. Investors in equity ETFs appear to have captured less of the ETFs’ total returns than investors in traditional stock mutual funds, and it appears this owes to the sort of rapid-trading Bogle had warned about.

The average dollar invested in Vanguard’s equity ETFs and and open-end funds outgained the average dollar invested elsewhere, which no doubt would have pleased him. But he’d probably have been bummed to see that even Vanguard’s equity ETF investors lost out on a portion of the ETFs’ total returns by mis-timing their purchases and sales. I can practically hear his booming baritone now.

* There was one aggregate consisting of all stock ETFs, another comprised of all stock mutual funds.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.

Thank you for writing this!

I wonder if the results would be different if SPY--the SPDR--trading was taken out of the calculation since a lot of the heavy dollar trading there are institutions?