I might have more to say about this either here or on other platforms but I’ve kept a close eye on an ETF line called “YieldMax”. They mainly offer single stock covered call ETFs and they’ve been aggressive in selling on yield. For instance here’s what greets you when you visit their site for YieldMax TSLA Option Income (ticker: TSLY).

Subtle it ain’t. Jason Zweig previously wrote about this crop of ETFs and their questionable marketing practices here. Jason said it well so no need to belabor his message—buyer beware.

Nevertheless, I’ve kept tabs on them. Their manager, Tidal, seems to engage in a practice of setting sky-high distribution rates and then, when income and gains from the ETFs’ underlying investments predictably fall short of funding those distributions, dipping into capital to cover the shortfall.

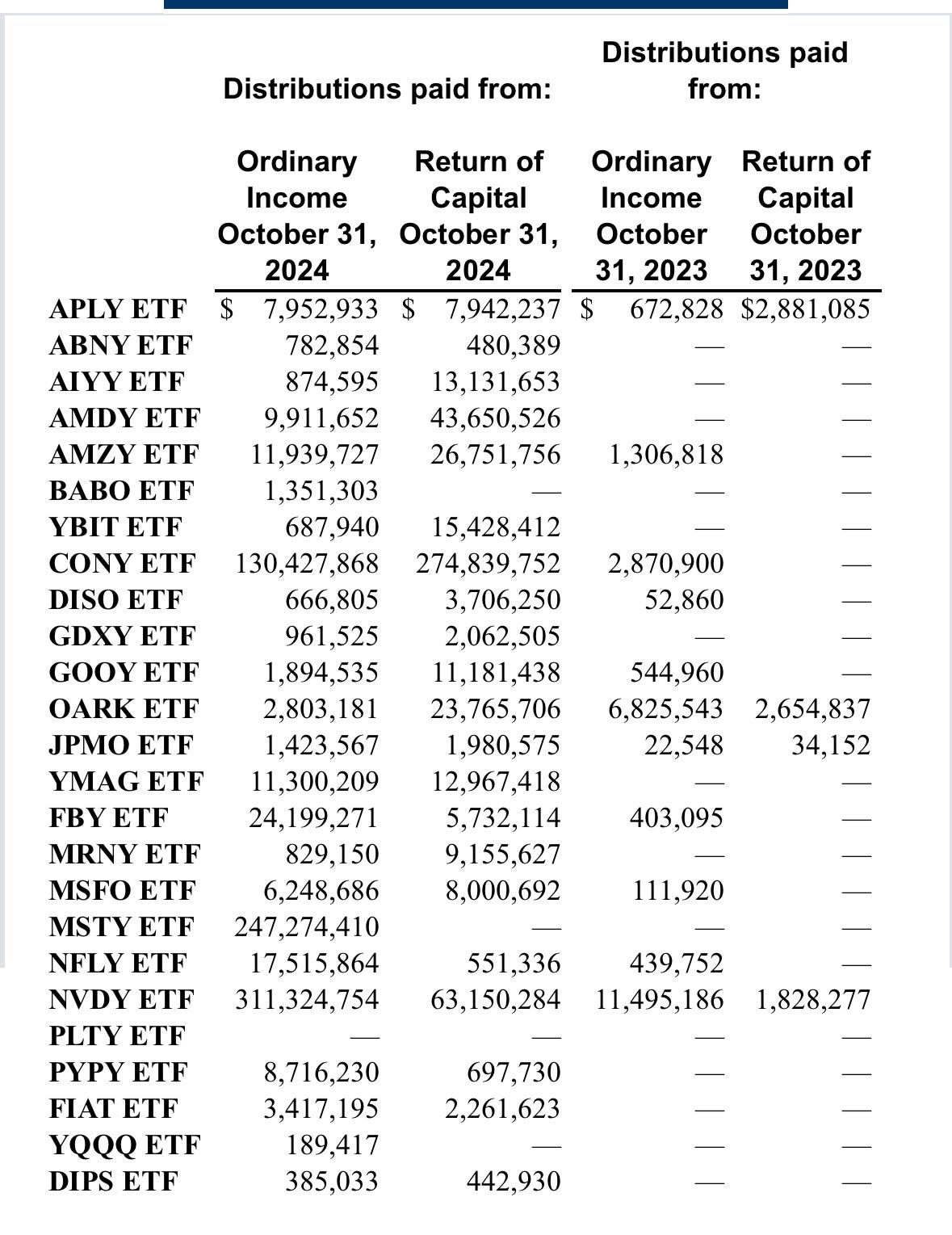

How pervasive has that practice of returning capital been? They just filed the annual report for the YieldMax ETFs’ fiscal year ended 10/31/24 and what it shows is that roughly two-thirds of the dollars they distributed were returns of capital.

In TSLY’s case, the distributions were almost entirely return of capital. All told, over its life, the ETF has made around $620 million of distributions, only about $40 million of which has been ordinary income. In other words 94 cents of every dollar they’ve sent back to shareholders has been their own capital.

Making matters worse, it appears* Tidal hasn’t always provided an accurate accounting of the tax character of these distributions over the course of the year. I tweeted about their having filed an amended semi-annual report (just before they filed their annual report) in which it appears they revised their reporting of the tax character of distributions the ETFs made over the six months ended 4/30/24.

(Bizarrely, the annual report appears to further revise the numbers they showed in the just-filed amended semi-annual report. For instance in the revised semi-annual report they were showing that TSLY’s distributions consisted of $143.2MM of ordinary income vs $80.4MM of return of capital. The annual report however shows that for the full year they distributed ordinary income of just $31.8MM, which suggests that in the back half of their fiscal year the ETF distributed -$111.4MM in ordinary income.)

The ETF’s tax filings are also hard to reconcile to what they just reported in the annual report. For instance here they seem to report that the ETF’s year to date distributions through 10/4/24 were 64% income/36% return of capital.

These seem like shell games to me. Tout a huge ‘distribution yield’, lure in credulous investors, levy high fees (Tidal earned nearly $28MM in aggregate across the ETFs in year ended 10/31/24 per the annual report), deliver a fraction of the underlying stocks’ returns, and return gobs of capital to uphold the pretense of generating huge ‘yields’.

* I say “appears” because I’m not a fund accounting expert. I suppose it’s possible the tax character of these distributions could change as the year wears on depending on how one defines “ordinary income”. Correct me if I’m wrong and I’ll update this accordingly.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.

Ok, you provided the negative aspects of Tidal ETFs. You say they "seem" like shell games. OK, that's fine. They have returned 94 cents of every dollar is return of capital, is that the full complexity of what is going on ? There are 2 sides to every story.

What is the positive side to investing in these funds ?