Kevin Meets Reality

An influencer; an upstart ETF; and economics.

The other day I tweeted about an SEC filing that gave notice of a plan to liquidate an obscure ETF with a funny name - The Meet Kevin Pricing Power ETF (ticker: PP).

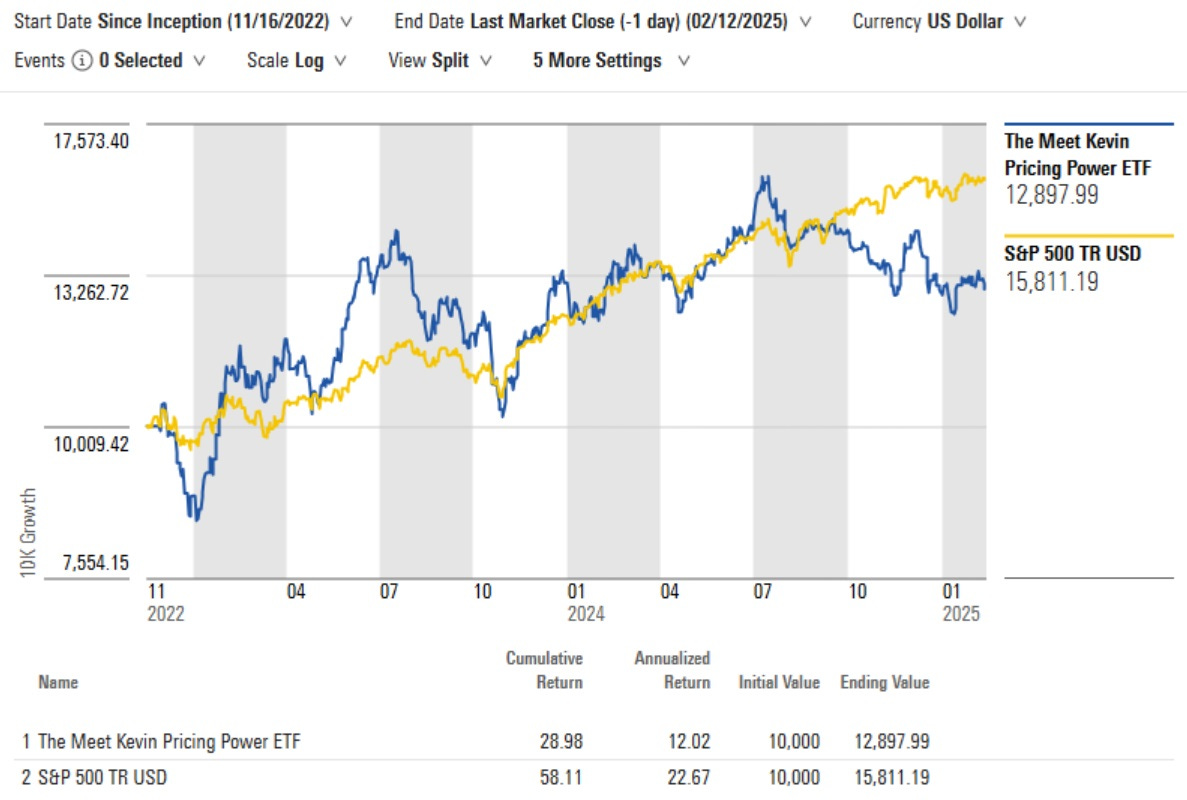

The ETF has been around since 2022. It doesn’t appear to have ever surpassed $50 million in net assets and it lagged the S&P 500 over its lifetime.

Little funds like this one come and go with some regularity and so it didn’t seem all that remarkable when I tweeted out the liquidation notice. I expected indifference, more or less.

Boy, was I wrong. People kind of went off, with a number of commenters dancing on the ETF’s grave. Why? The ETF’s manager and namesake, Kevin Paffrath, seems to be polarizing. He’s a YouTube influencer who has gained a large following offering advice on real estate and general investing matters. The Wall Street Journal even profiled him back around the time he launched the ETF. But apparently he’s not everyone’s cup of tea.

Interestingly, Paffrath posted a video on his YouTube channel in which he laid out the rationale for closing the ETF. To save you time, the explanation went something like this: 1) It was costing him a lot of money; 2) he wasn’t fully prepared for the pressure of running public money.

(He also lapsed into self-pity, seeming to suggest the ETF was diverting him from other pursuits he considered more worthwhile, and blaming the ETF’s administrator for not executing his trade instructions in a timely way, among other gripes.)

Second point first: That’s kind of lame. He launched the ETF presumably because he was enticed by the prospect of earning notoriety and further cashing in on his public profile. So for him to say he wasn’t expecting the glare to be so bright strikes me as a bit of a cop-out. You can’t have your cake and eat it too.

The first point is more nuanced, though: I wouldn’t fully discount his claim he was losing money. Ironically, the way they set the ETF up kind of obscures its economics: It’s a “unitary fee”, whereby the ETF charges a single line-item amount that’s meant to cover the cost of all services — portfolio management as well as the other operating expenses of the fund - but doesn’t break out those components individually. So it’s hard to tell how much he was having to dip into his own pocket to cap its fees.

But judging from similar arrangements I’ve seen, it probably wasn’t nothing. Subscale ETFs like this will sometimes waive fees in order to keep costs low. When they do that, they effectively forego a portion of their revenue stream and in cases where the overages exceed the entirety of their management fees then they can end up losing money. Not unimaginable.

Lessons

To state the obvious, social-media influence won’t necessarily translate to commercial success in a fund or ETF. We have seen this movie before. For instance, Barstool’s Dave Portnoy got behind an ETF that ultimately came and went with a whimper.

Growing your newsletter subscriber base or your follower count is a different proposition than adding alpha in public markets. The latter is way harder to pull off. Paffrath comes off as not having really grappled with this reality. Social media can be a decibel business. Money management doesn’t care how loud you shout to be heard above the din.

Getting an ETF off the ground takes grit and stick-to-it-iveness, which not every fledgling manager possesses. The risk to investors is they take a leap of faith, allocating capital to an upstart fund, only to have their capital returned to them and, with that, the unwelcome decision of how to redeploy it. Buyer beware, all the way.

At times it can seem that managers think they’re doing you a favor by availing themselves of your capital. They’ve got it backwards. It’s on them to earn your confidence. It takes time and effort to amass that kind of track record. Many don’t because they can’t get past their own self-regard.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.