Even When Thematic Funds Arrive Early, Investors Come Unprofitably Late

The case of Global X Lithium & Battery Tech ETF

I recently wrote a piece about thematic investing in which I compared the return of the average dollar invested in theme-based funds to the return of the average dollar in the dullest type of equity fund I could think of (Target-date 2050 funds). I found the return of the average dollar invested in thematics lagged that of the average dollar in target-date 2050 funds by around 14% per year. Not great!

Ian Salisbury of Barron’s kindly took notice of the research and wrote a story putting his own valuable spin on it. In his article, Ian quoted a representative of an ETF firm who, in defending thematic investing, cited as his example a “Lithium & Battery” ETF his firm had launched in 2010.

“People are late to the party,” Ptak said in an interview Friday.

Of course, while some investors may pile in too late, that’s not necessarily fund companies’ fault. Palandrani points out that the $1.1 Global X Lithium & Battery Tech ETF, one of the company’s most popular thematic funds, launched in 2010.

“That was well before electric vehicles were even a thing!” he said.

The Global X rep’s point was that they brought the ETF out long before that theme had entered the zeitgeist (which eventually it did via Tesla and the shift toward electrification), not after the trend had already taken flight. Point taken. There are some examples where firms have launched thematic products in a theme’s formative days and this appears to be one of those. So I appreciate him countering as he did.

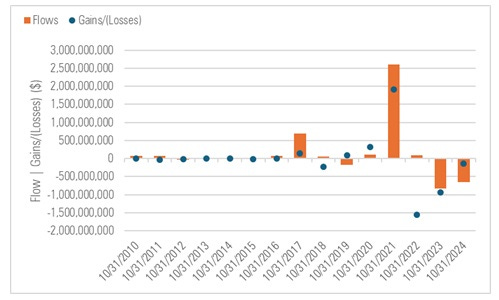

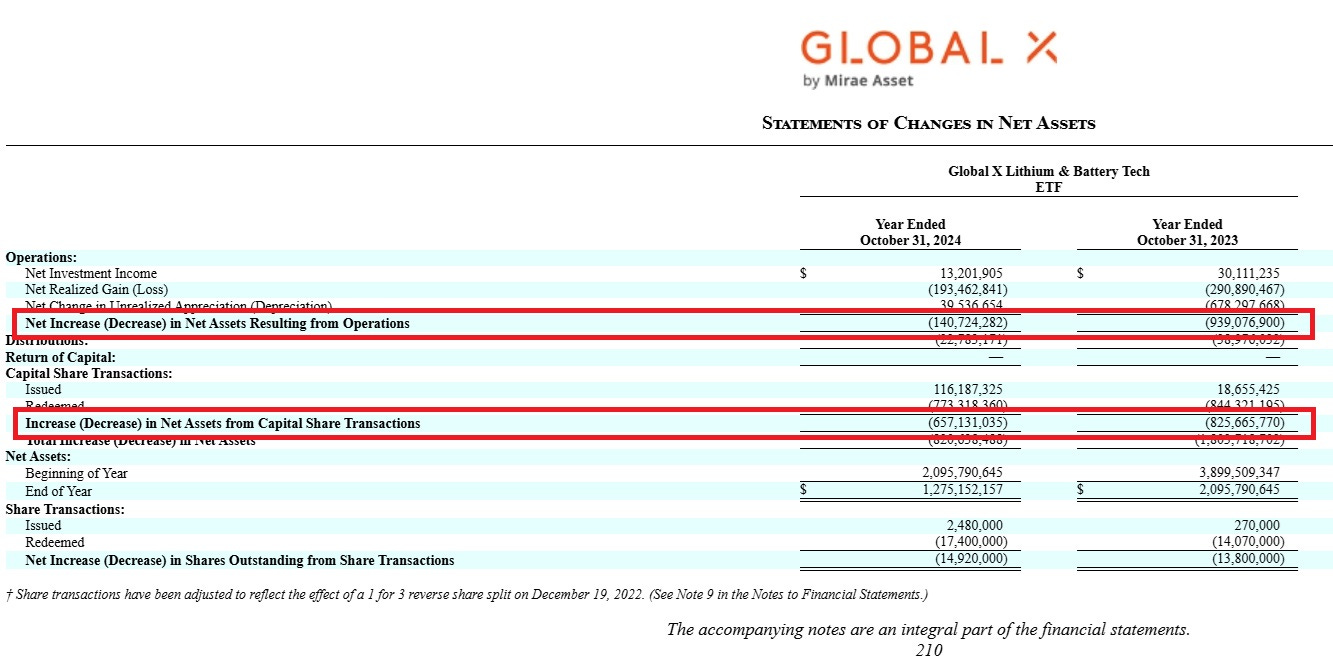

That said, the Global X ETF he cited kind of epitomizes what I was writing about: Despite gathering nearly $2.1 billion* of cumulative inflows from its July 2010 inception through Oct. 31, 2024, the ETF had incurred almost $450 million of lifetime net losses as of that date. Why? Mainly because after $2.6 billion poured into the ETF in the 12 months ended Oct. 31, 2021, it lost $1.6 billion over the subsequent year, $939 million the year after that, and another $142 million the following year.

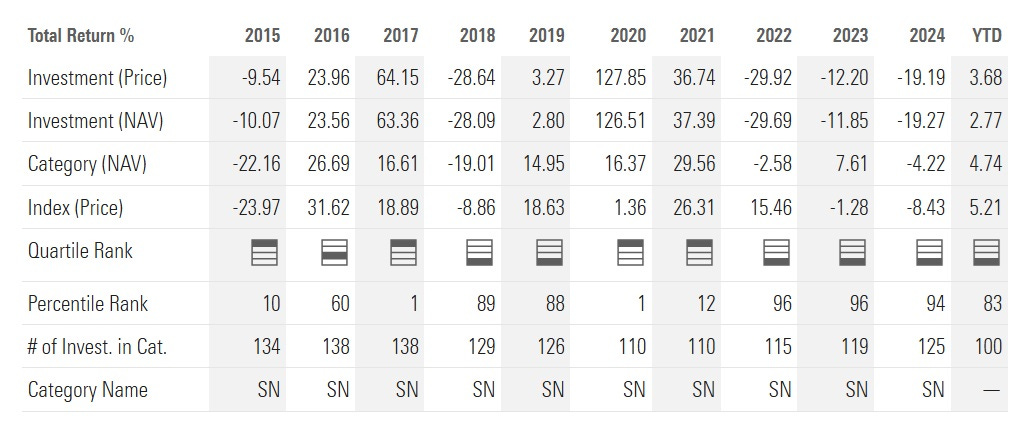

What happened? It’s kind of the same old story, I’m afraid. The ETF soared in 2020 (+128%) and 2021 (+37%) but then it sank in 2022 (-30%), 2023 (-12%), and again last year (-19%). Unfortunately that wasn’t the first time — a similar pattern played out in 2017, which saw nearly $700 million in inflows amid a heady 64% gain that year, only to suffer a nearly 29% loss the following year.

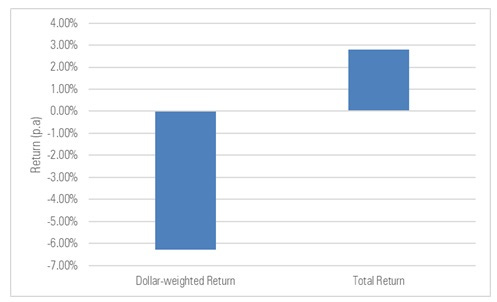

How much did the average dollar invested in this Global X ETF earn since inception and how does that compare to the ETF’s time-weighted (i.e., “total” return, i.e. buy-and-hold return)? Based on my estimates, the average dollar lost about 6.3% per year from Aug. 1, 2010 through Dec. 31, 2024 while the fund earned a 2.8% annual total return over that span.

So in this particular case the fund company launched a thematic fund at a time the theme wasn’t proven and it didn’t really catch on until some years later. But when it did—circa 2020 and 2021—the flows came late, performance promptly rolled over, and as a result investors caught it mostly in the teeth. This explains the large gap between the ETF’s dollar-weighted return and its total return.

Wish it wasn’t so but alas. Fwiw.

* All of these figures are taken from the “Statement of Changes in Net Assets” Global X filed in the annual report for the ETF from its 2010 inception through 2024. The ETF has an Oct. 31 fiscal year-end, so that’s why the figures cited are for periods ended that date. The gains and losses I cite are from the line item of the Statement of Changes labeled “Net Increase (Decrease) in Net Assets Resulting from Operations“. The flows are from the line item “Increase (Decrease) in Net Assets from Capital Share Transactions“. Here is what it looked like in their most recently filed annual report for the ETF.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.

For a highly volatile fund like LIT, it seems it could be useful for people to stay a while longer or not go in at all. Any fund that gains 100% might as easily lose 100%. Over time that might pay off, but most of the time you can’t catch something like that. Certain media highlights big gains but often times the gain is high variance. Thematic funds are highly correlated by using a theme so go up and down together. Themes can present concentration risk if not diversified properly, and many aren’t.