Asset Allocations Look Out of Whack But It Could be Worse

What the shift in the mix of assets across Vanguard's funds seems to show

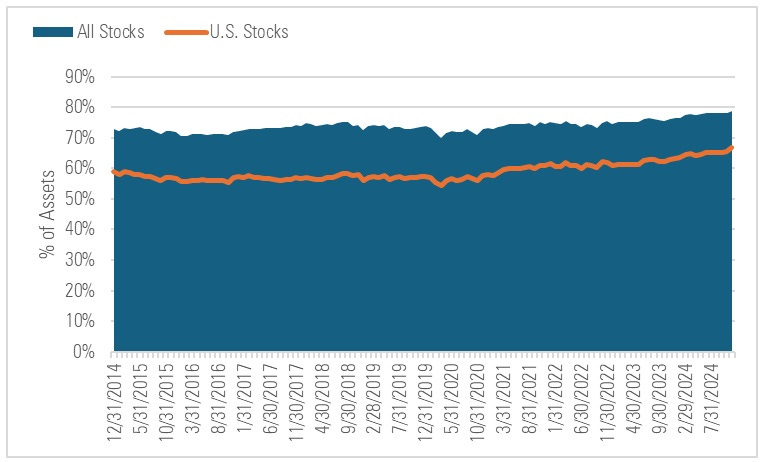

I’m working on a different project but as part of it was poking around a bit, looking at the mix of assets spread across Vanguard’s U.S. stock, int’l stock, taxable bond, and municipal bond funds. Here’s a time-lapse of the value of the assets invested in those funds over the ten years ended 11/30/24 (includes ETFs; excludes fund-of-funds):

At the start, there was a roughly 73/27% split between assets in Vanguard stock funds (58.8% U.S. stock funds, 14% int’l stock funds) and bond funds (22.4% taxable bond funds, 4.8% muni funds). It held steady through 2019, then Covid hit and the U.S. stock fund weight began to climb (61% of assets by 12/31/21; 63% by 12/31/23; 67% by 11/30/24). Consequently, the stock/bond split had drifted to 79/21% by the end.

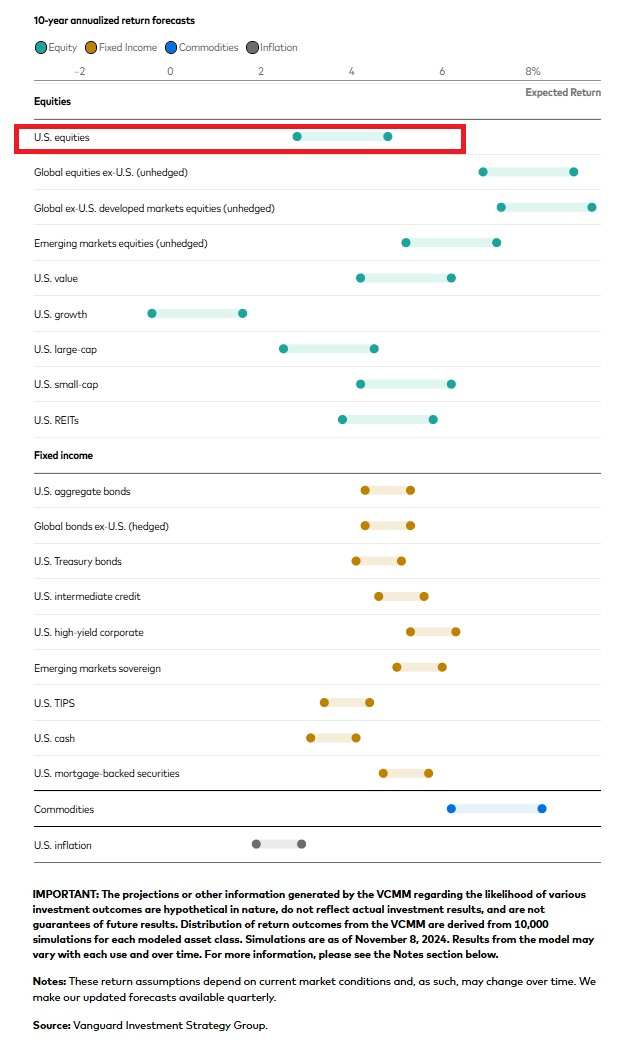

On one hand, that’s concerning. Vanguard recently put out its capital markets forecasts and they have fairly subdued expectations for…U.S. stocks.

More generally, with four of every five dollars in stocks and eighty-five cents of every stock dollar in U.S. equity funds, it does seem like things have gotten out of whack*. You’d like to see less in stocks, U.S. stocks especially, and more in bonds, which Vanguard expects to return a bit less than global stocks but with far less volatility.

On the other hand, while the stock weighting has risen, it’s not as lopsided as it could have been. Back of the envelope, I found that had investors bought on 12/1/14** and hypothetically left those investments untouched until 11/30/24, the U.S. stock sleeve alone would have come to soak up almost 80% of the portfolio. All told, the stock/bond split by the end would have been roughly 87/13% stocks vs. bonds.

So it could have been worse. To illustrate, here’s a comparison of the actual asset mix as of 11/30/14 and 11/30/24 as well as what the hypothetical mix would have been by 11/30/24 assuming buy-and-hold.

What kept things from getting even more off-kilter? Probably, the biggest thing is investors pumped more than a trillion dollars into Vanguard’s taxable bond funds ($994B) and muni bond funds ($100B) over the decade ended 11/30/24. That roughly matched their contributions to Vanguard’s U.S. stock funds ($618B) and int’l stock funds ($475B) but it accounted for a much bigger share of the beginning asset balance.

Whether it’s periodic rebalancing, riding a glidepath towards bonds, or demographics (i.e., retiring investors de-risking by selling stock funds to buy bond funds), I couldn’t say. But it has helped to partially counterbalance the shift towards equities that’s been propelled in no small part by stocks’ larger gains.

To sum up: Things could be better from an overall asset allocation standpoint, but they also could be worse.

* For the record, this isn’t Vanguard’s fault. They can’t control where investors put their money or how they maintain their asset mix over time. Vanguard exerts the greatest control through the target-date and target-risk fund-of-funds they manage but you haven’t seen drift in those funds’ asset mixes like you’ve seen across the fund complex as a whole.

** The initial mix would mirror what it actually was on 11/30/24. For purposes of my back-of-the envelope, I allocated 59% to Vanguard Total Stock Market Index Fund (proxy for U.S. stocks), 14% Vanguard Total Int’l Stock Market Index Fund (int’l stocks), 22% Vanguard Total Bond Market Index Fund (taxable bonds), and 5% Vanguard Intermediate-term Tax-exempt Fund (muni bonds).

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.