This weekend saw a couple of articles—one from the Journal, another from the Times—about individual investors bailing out of the market. The stories ranged from people taking some risk off (i.e., more bonds, less stocks) to someone going to cash as well as (in the most unfortunate case) a person who yanked half her assets entirely out of her 401k plan. The upshot of these articles is people are jumpy and acting on emotion.

Given this, I decided to take a peek at target-date fund flows. Target-date flows are a decent proxy for what investors are doing at large because they’re used by such a broad range of individuals, from newbies to retirees. Also, because they’re so-often the default plan option, they serve as kind of a bellwether for millions of 401k plan participants. As of Feb. 28, 2025, there was about $2 trillion in these funds.

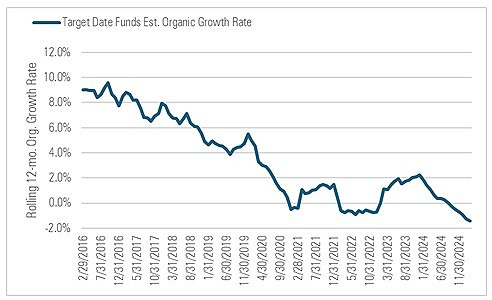

Have investors been bailing from target-date funds? There’s some weakness that’s apparent. Over the last twelve months, target-date funds have seen around $26 billion in net outflows and this is the ninth consecutive month of net redemptions.

But a few caveats apply:

It’s not a ton of money as a percentage of assets. The $26 billion in outflows over the year ended Feb. 28, 2025 is equivalent to around 1.4% of their aggregate assets a year prior. It’s nonetheless worth noting that this is the slowest growth these funds have ever seen (they saw inflows even amid the global financial crisis).

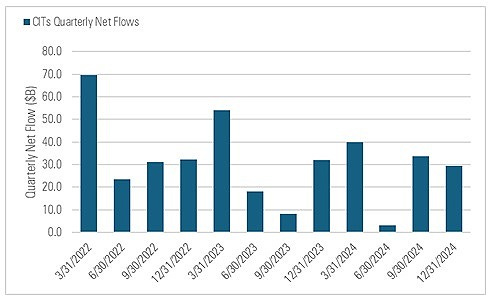

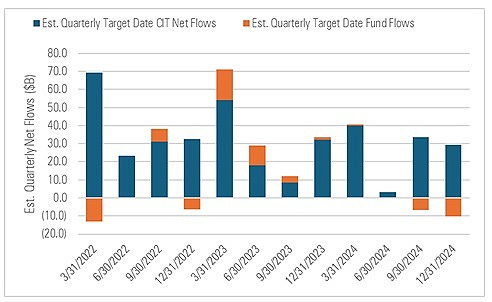

It’s not the full picture. You also have to account for flows to target-date collective investment trusts (CIT). In some cases, CIT inflows will offset the outflows from target-date funds, as when plan sponsors convert from target-date funds to CITs to wring out extra cost savings. Unfortunately, CITs report on a voluntary basis and do so on a lag so I don’t have data more current than Dec. 31, 2024 for those that do report. Here’s what the flow picture looked like for target-date CITs up to then:

Last year, the target-date CIT managers that report flows to us (a list that spans the largest players including Vanguard, Fidelity, Blackrock, T. Rowe Price, and State Street, among others) estimated they’d hauled in around $106 billion in net new monies total. Here’s what the picture looked like when you took quarterly target-date CIT and fund flows together.

It’s possible that target-date CITs have seen outflows this quarter just like target-date mutual funds have but that would represent a pretty sharp break from trend. We should know more in a few months as these CIT managers report.

So, in summary, while it looks like we’re seeing some target-date fund investors bail out, it doesn’t look torrential and it’s quite possible that it’s more than offset by continued inflows to target-date CITs. Given that, I’d consider the Journal and Time stories to be more “anecdata” until proven otherwise.

The views and opinions expressed in this blog post are those of Jeffrey Ptak and do not necessarily reflect those of Morningstar Research Services or its affiliates.

Thanks for settling the matter. I was puzzled at the headline that investors are leaving target-date funds, except as part of a much larger demographic trend about the aging of America, but I didn't think that demographics would yet lead to net outflows. You answered my unasked questions: It's the CITs.